If you’re Googling “Dividing property in Tennessee without a lawyer,” you’re not alone. Many Tennesseans go through divorce without hiring an attorney, either to save money or because their case is relatively simple. The idea can feel overwhelming, but here’s the truth: with the right information, organization, and mindset, you can handle property division on your own.

This guide explains Tennessee’s laws in plain English and gives you step-by-step instructions for dividing property during divorce without the legal jargon.

The Legal Baseline: What Tennessee Law Says About Property Division

Tennessee is not a community property state. Instead, it follows equitable distribution, which means the court divides marital property in a way that’s fair, but not always 50/50.

The law comes from Tenn. Code Ann. §36-4-121, which tells judges to look at factors like

- Length of the marriage

- Each spouse’s income and debts

- Contributions to the marriage (financial and non-financial)

- Economic misconduct, if any

Translation: The court aims for fairness, not automatic equality. Understanding this helps you set realistic expectations when dividing property.

Step 1: Classify Your Property (Marital vs. Separate)

The first step is figuring out what belongs in the “marital pot.”

- Marital property: Anything acquired during the marriage (house, cars, wages, retirement contributions).

- Separate property: What you owned before marriage, inheritances, or gifts to one spouse.

- Mixed property: Assets that started separate but got blended, like using inheritance money for a joint home.

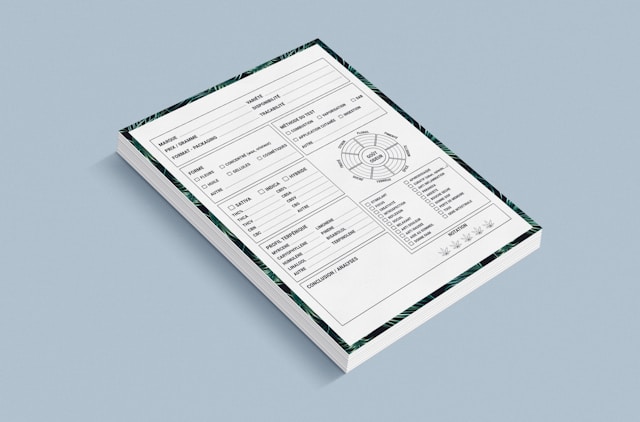

Property Classification in Tennessee Divorce

| Marital Property | Separate Property |

| Income earned during the marriage | Property owned before the marriage |

| Real estate purchased after marriage (home, land) | Inheritances received by one spouse (kept separate) |

| Vehicles bought during the marriage | Gifts specifically given to one spouse (not both) |

| Retirement contributions made during marriage | Property purchased with separate funds (kept separate) |

| Bank accounts opened/jointly funded during marriage | Compensation for personal injury (pain & suffering portion) |

| Debts acquired during the marriage (credit cards, loans) | Assets explicitly protected by a prenuptial/postnuptial agreement |

| Business started or grown during the marriage | Appreciation of separate property (unless due to marital contributions) |

Step 2: Gather Your Documents (The DIY Evidence Packet)

Courts need proof, not just your word. Build an evidence packet that includes:

- Bank statements (at lea

- st 12 months back)

- Mortgage and deed records

- Vehicle titles

- Retirement and pension statements

- Pay stubs and tax returns

- Proof of inheritances (wills, letters, bank deposits)

Step 3: Valuing Property Without Experts

You don’t always need an appraiser. Here’s how to handle valuations on your own:

- Homes: Use county tax appraisals or a realtor’s free Comparative Market Analysis (CMA).

- Cars: Use Kelley Blue Book or NADA online values.

- Retirement accounts: Use the latest account statement.

- Crypto or stocks: Screenshot exchange values on the valuation date.

If you own a business or have complicated investments, consider hiring an expert. But for most people, these DIY methods work just fine.

Step 4: Filling Out the Right Forms

To officially present your property division, you’ll need Tennessee’s divorce forms. These include:

- Divorce petition

- Financial affidavit (income, assets, and debts)

- Proposed property division form (often a spreadsheet listing assets, values, and who gets what)

You can download forms from the Tennessee State Courts website. A clear spreadsheet showing assets, debts, and proposed division will impress both mediators and judges.

Step 5: Mediation & Settlement Without a Lawyer

In Tennessee, many divorces require mediation before trial. Think of it as guided negotiation with a neutral third party.

Here’s how to succeed without a lawyer:

- Come prepared: Bring your evidence packet and proposed division spreadsheet.

- Stay calm: Focus on solutions, not past arguments.

- Be flexible: Sometimes giving up a small item avoids a costly fight.

If you reach an agreement, the mediator will help you draft a settlement for court approval.

Step 6: Presenting Property Division to the Court

If mediation doesn’t work, you’ll present your plan in court.

Judges expect:

- A clear explanation of what’s marital vs. separate property.

- Documentation to back up your claims.

- A division plan that looks fair under the law.

Sample script idea:

“Your Honor, this spreadsheet shows our assets, debts, and my proposal for division. I based it on Tenn. Code Ann. §36-4-121 and the factors of our marriage.”

Traps to Avoid (Pro Se Divorce Mistakes)

Many self-represented spouses lose property because of preventable mistakes. Watch out for these:

- Failing to trace separate property (inheritance money in a joint account becomes “marital”).

- Forgetting to divide debts (joint credit cards, car loans).

- Ignoring retirement accounts (you need a QDRO to divide pensions and 401(k)s).

- Assuming 50/50 = fair (equitable doesn’t always mean equal).

When You Shouldn’t Go Pro Se

Dividing property without a lawyer is fine in simple cases. But if you have:

- A family business

- Significant investments or trusts

- Hidden assets or high conflict

- Unvested stock options or crypto

Hire an attorney. Complex cases can cost you far more if mishandled.

Practical Tools & Resources

Here’s a toolkit to make the process smoother:

- Tennessee Divorce Forms Portal → tncourts.gov/forms

- Property division spreadsheet template (create one in Excel/Google Sheets)

- QDRO resources → National QDRO Center for retirement division

- Mediation directories → Tennessee Association of Professional Mediators

FAQ

Q1. Is Tennessee a community property state?

No. Tennessee follows equitable distribution, not community property. This means courts aim for a fair split, which is not always a 50/50 division.

Q2. What’s the difference between marital and separate property?

- Marital property includes assets and debts acquired during the marriage.

- Separate property includes assets owned before marriage, inheritances, and gifts specifically given to one spouse.

Q3. Can separate property become marital property?

Yes. If you mix (“commingle”) separate funds with marital accounts or put your spouse’s name on a separate asset, it may lose its separate status.

Q4. How do Tennessee courts divide marital property?

Courts consider factors like the length of marriage, contributions of each spouse, earning capacity, debts, and even financial misconduct. The goal is fairness, not an automatic 50/50 split.

Q5. Do I need a lawyer to divide property in Tennessee?

Not always. Simple cases with few assets can be handled without a lawyer. But if you own a business, have retirement accounts, or have complex property, professional legal help is highly recommended.

Q6. What happens if one spouse hides assets?

Courts take hidden assets seriously. If discovered, judges may award a larger share of property to the other spouse and penalize the spouse who concealed assets.

Q7. How are retirement accounts divided in a Tennessee divorce?

They require a special court order called a QDRO (Qualified Domestic Relations Order) to divide without triggering taxes or penalties.

Q8. What about debts—who pays them?

Debts acquired during marriage (credit cards, loans, mortgages) are generally divided as marital property. But the court may assign them unequally if fairness requires it.

Conclusion

Dividing property in Tennessee without a lawyer isn’t easy, but it’s doable. By classifying assets, gathering documents, valuing property, and presenting a clear plan, you can guide your divorce toward a fair outcome.

The key is preparation. Stay organized, know the difference between marital and separate property, and don’t be afraid to ask for professional help if your case gets complex.

For deeper context, check out our pillar article: